“This is over performing beyond First Capital Research (FCR) expectations which was USD 3 billion for the first Half of 2023 end ,” said FCH in their PRE-POLICY ANALYSIS released in June 2023.

“The 26.1% Month on Month (MoM) improvement in official reserves position was aided by gross purchases of USD 663 Mn by the CBSL in May-23 (USD 148 Mn in Apr23 and YTD USD 1.7Bn) from the domestic foreign exchange market, ease of pressure on BOP position (BOP surplus of USD 883.0 Mn YTD) from reduced trade balance (deficit narrowed by 53.8%YoY in Jan-Apr 2023), improved earnings from Remittances and Tourism (+81.0%YoY and 17.8%YoY, respectively).

“Moreover, the World Bank approved USD 800 Mn in budgetary and welfare support for Sri Lanka at its board meeting on 28-June. Of the proposed World Bank funding, USD 500.0 Mn will be for budgetary support and is likely to come in two tranches of USD 250.0 Mn each whilst the remaining USD 200 Mn will be earmarked for programmes to assist the poor.”

The first tranche is likely to be disbursed immediately after board approval with the next possibly in October, as the bank watches the progress of Sri Lanka’s debt restructuring and the first review of the IMF programme, due in September.

Meanwhile, with the revocation of mandatory forex sales requirement by licensed banks to the Central Bank and discontinuation of the daily guidance on exchange rates in early March 2023, led to an improvement in the domestic foreign exchange market, which positively affected the LKR and resulted towards a 15.5% appreciation of the LKR against the USD as of June 23, 2023.

Given the improving indicators, we believe that the Sri Lankan economy is positioned well to absorb another downward adjustment in the policy rates during the upcoming monetary policy meeting.

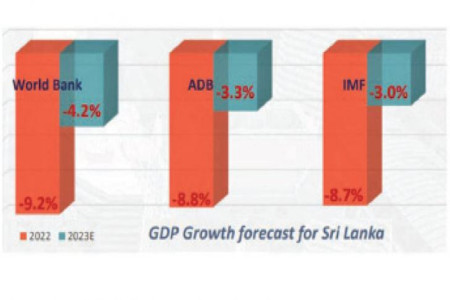

Given the weak performance during 2022 and the bleak outlook forecasted by multiple multilateral agencies (World Bank -4.2%, ADB -3.3% and IMF - 3.0%), and to achieve the GoSL target of gradual economic recovery from late 2023, we believe the CBSL may have the option to reduce rates further and propel the economy and achieve the envisaged growth target for 4Q 2023.

Provided by SyndiGate Media Inc.

(Syndigate.info).