By Rohana Jith

Sri Lanka’s second round of discussions with bondholders on the external debt restructuring is to conclude next week paving the way to reach an agreement with the Steering Committee of the Ad Hoc Group and Paris Clun including India and separately with China

These negotiations are primarily centered on the bondholders' proposal, notably the introduction of a Macro-Linked Bond (MLB).

Initial proposals suggested a haircut of 20% on existing bonds, with subsequent revisions in April proposing an increased haircut of 28%, while Public Debt Interests (PDIs) remained unaffected.

Following discussions, bondholders revised their proposal in April 2024 to address government concerns, with the IMF has assessed the latest proposal of the ad hoc group,

Sri Lankan government’s announcement of the agreement with private bondholders and moving out of bankruptcy is expected next week as some of the Steering Committee members of the Ad Hoc Group of Bondholders, which consists of some of the country’s biggest private holders of debt will reach agreement on “restructuring terms soon..

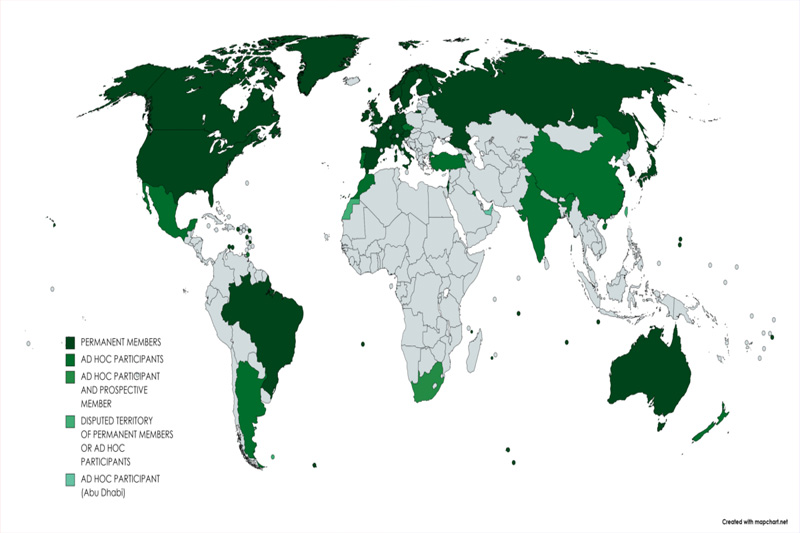

The Steering Committee comprises 10 of Sri Lanka’s largest bondholders and the Ad Hoc Group controls “approximately 50 percent of the aggregate outstanding amount of [international sovereign bonds] ISBs.” These bondholders hold about $12 billion of Sri Lanka’s total debt.

On March 11, the Ad Hoc Group, which is advised by White & Case and Rothschild & Co., sent their debt treatment proposal to the government.

The government sent its proposals to the group on March 25, which were rejected by the Steering Committee of the Ad Hoc Group when the two sides sat down for discussions on March 27 and 28.

In its proposal, the Ad Hoc Group calls on the Sri Lankan government to issue a Macro-Linked Bond (MLB) as a part of new securities that will be offered to those who hold existing bonds.

In a press release issued on October 2023, the Group stated that the MLB is designed to be “liquid and index-eligible,” with payouts that “are linked to the evolution of Sri Lanka’s gross domestic product

Before the meetings, the International Monetary Fund (IMF) conducted an initial, informal evaluation of the proposals regarding their alignment with Sri Lanka’s IMF-supported program parameters and goals for debt sustainability.

According to the finance ministry, issues relating to MLBs are the main stumbling block in reaching an agreement.

The Ad Hoc Group proposal recommends a combination of cash and payment-in-kind coupons, with cash coupons starting from 2028 offering interest rates ranging between 8 and 9.5 percent, depending on the maturity.

The government is s now focusing on its $25 billion debt with sovereign bondholders’ .The bondholders’ proposal was on the introduction of a Macro-Linked Bond (MLB).

Their March 2024 proposal in March suggested a 20 percent haircut on the minimal amount of existing bonds.

The revised proposal in April 2024 increased the haircut to 28 percent with no haircuts on public debt interests (PDIs) in both March and April proposals.

The minute differences between the proposals of the Ad Hoc Group and the government have now been settled and the agreement with both sides will be announced in the coming week.

Economic analysts argue that the alleged impasse between the two sides is only an attempt by the government to convince Sri Lankans, in an election year, that it is trying its best to get a good deal from the private creditors

Sri Lanka’s experience demonstrates that effective debt management is not just about managing numbers but also about building robust institutions and capacities.”

The journey underscores the importance of transparent, accountable governance and the need for international support and cooperation in times of crisis, he said.

Sri Lanka prioritized addressing gaps in public debt management by drafting a consolidated Public Debt Management Act, ensuring clarity and legal robustness and establishing a centralized Public Debt Management Office with operational autonomy.

In another development, Sri Lanka’s central bank has repaid 225 million US dollars to the Reserve Bank of India in the first quarter of 2024, on top of earlier repayments, official data shows.

In October 2023 the Sri Lanka gave a Treasury guarantee to cover a 2,601.43 million dollar credit from RBI to Sri Lanka’s central bank.

Sri Lanka’s got deferred payments due to India via the Asian Clearing Union during the worst currency crisis triggered by rate cuts since the creation of the central bank.

According to official data the outstanding debt due to the Reserve Bank of India fell to 2,226.43 million US dollars by end March 2024 from 2,451.43 million dollars in December. From October the central bank had repaid 375 million dollars to India.

Meanwhile Sri Lanka’s Financial Intelligence Unit (FIU) and the Commission to Investigate Allegations of Bribery or Corruption (CIABOC) have agreed to exchange information on investigations and prosecutions of money laundering, bribery or corruption, and other related offences.

The new Anti-Corruption Act, No. 9 of 2023 has empowered the CIABOC to share information relevant to any investigation with any local law enforcement authority or any other Government authority.

“The MoU between the CIABOC and the FIU would enable both institutions to exchange information, which is vital for prevention, detection and prosecution of money laundering, bribery or corruption, and other related offences,” the central bank said in a statement.