Displaying items by tag: Hamas leader refuses to acknowledge killing of civilians in Israel

Tuesday, 07 November 2023 11:38

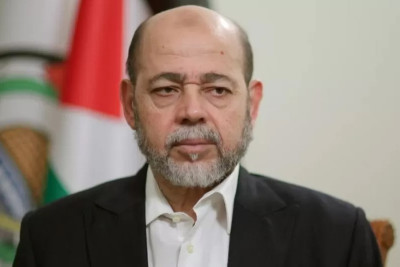

Hamas leader refuses to acknowledge killing of civilians in Israel

A senior Hamas leader has refused to acknowledge that his group killed civilians in Israel, claiming only conscripts were targeted.

Published in

International News