editor

Over 15,000 Sri Lankan children suffer in acute malnutrition– report

Over 15,000 children aged under 5 years are reportedly suffering from Severe Acute Malnutrition (SAM), as per the ‘Nutrition Month’ report published by the Family Health Bureau of the Ministry of Health, for the year 2023.

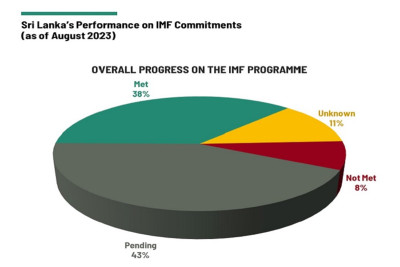

Sri Lanka fulfills 38 of the 57 IMF commitments by August

Sri Lanka fulfills 38 of the 57 IMF commitments due for August in its 17th programme with the International Monetary Fund (IMF),

The progress on 11 commitments remains “unknown”, while eight are now classified as “not met”.

Sri Lanka ranked as one of best 50 islands in the world for travel in 2023 by Big 7

Sri Lanka has been listed as one of the 50 best islands in the world for travel for 2023 by Big 7 Travel.

NMRA to act strict on pharmacists selling drugs sans prescription

The National Medical Regulatory Authority (NMRA) will act strictly on the instances of selling medicines sans prescription when a growing trend of issuing antibiotic drugs without doctors' advice has been evident recently.

NASA forms new UFO taskforce to study aerial phenomena despite no alien evidence

NASA has created a new UFO research division that will continue studying the phenomena even though the space agency has ruled out aliens.

Oil hits 2023 highs on tight supply outlook

Oil prices climbed yesterday to their highest this year, as expectations of tighter supply outweighed worries about weaker economic growth and rising U.S. crude inventories.

Sri Lanka produces furnace oil using garbage recycling process

Government will implement a program to recycle garbage and petroleum waste at a recycling plant to be seet up at Kerawalapitya environmental conservation park beig developped at present, ministr of urban development Prasanna Ranatunge said.

Central bank identifies informal remitters alleged of money laundering

Sri Lanka’s central bank has identified informal money remitters who transfer money through hawala and undiyal possessing high-risk in the island nation’s money laundering activity.

IMF’s first review of bailout program for Sri Lanka gets underway

The inaugural meeting for the International Monetary Fund’s first review of the Extended Fund Facility (EFF) program for Sri Lanka commenced in Colombo on Thursday (Sept. 14) anidst mounting public protests against its anti conditions of high taxing and energy pricing conditions. .

IMF’s first review of bailout program for Sri Lanka gets underway

The inaugural meeting for the International Monetary Fund’s first review of the Extended Fund Facility (EFF) program for Sri Lanka commenced in Colombo on Thursday (Sept. 14) anidst mounting public protests against its anti conditions of high taxing and energy pricing conditions. .

IMF’s first review of bailout program for Sri Lanka gets underway

The inaugural meeting for the International Monetary Fund’s first review of the Extended Fund Facility (EFF) program for Sri Lanka commenced in Colombo on Thursday (Sept. 14) anidst mounting public protests against its anti conditions of high taxing and energy pricing conditions. .

IMF’s first EFF review for Sri Lanka kicks off today

Sri Lanka will soon find the status of the progress made in its reform efforts, with the International Monetary Fund (IMF) all set to kick off the review process today.

Sri Lanka turns deaf to call for international probe into Easter attack

Sri Lanka appears to be turning down calls for an an internationally monitored investigation into Easter Sunday bombings since it rapped yesterday the Office of High Commissioner for Human Rights (OHCHR) for trying to use incorrect and unsubstantiated information from biased sources in analysis in this regard.

SL fulfils 39% of tourist arrival target set for September

Sri Lanka has welcomed over 46,000 tourists in the first two weeks of September, the provisional data from the Sri Lanka Tourism Development Authority showed.

Authorities admit migration of doctors beyond their control

Medical specialists migrate due to low salaries

Foreign countries eye SL specialists for higher salaries

Government imposes zero Custom tariffs on electric vehicles

A zero customs tariff on the CIF value for imported electric vehicles has been imposed with the aim of encouraging domestic production of electric vehicles (EVs) and advancing sustainable transportation, .

Singapore based Japanese firm to clean Beira Lake polluted water

A pilot project is to be implemented to improve the water quality of Beira Lake using micro–Nano Bubble Technology, Carbon Fiber Biofilm technology and environmentally friendly enzymes.

Ukraine war: Overnight air attacks reported on Sevastopol and Izmail

Govt. delays SVAT system abolition to April 2025 due to strong opposition

- Original SVAT abolition date of January 1, 2024, pushed to April 1, 2025

- Phased repeal of SVAT promised with new VAT repayment system

- President seeks Cabinet approval for SVAT abolishing date change

- Govt. acknowledges concerns, cites the need for a strong VAT repayment system

Amidst strong opposition from exporters and the country’s business chambers, the government has decided to postpone the earlier decision to abolish the Simplified Value-Added Tariff (SVAT) system until April 1, 2025.

The abolishment was originally scheduled to come into effect from January 1, 2024.

The government has also assured that SVAT will be repealed in a phased manner while establishing a strong, new Value-Added Tax repayment system.

This week, President Ranil Wickremsinghe, acting in his capacity as the Minister of Finance, Economic Stabilization, and National Policies, sought the Cabinet of Ministers’ approval to amend the implementation date for the removal of the SVAT system to April 1, 2025.

This decision aligns with the resolution made during the committee stage of the Parliament’s deliberations on the Value-Added Tax (Amended) Bill.

Earlier, the concurrence of the Cabinet of Ministers had been granted to submit to the Parliament the draft bill prepared by the Legal Draftsman in order to revise the Value–Added Tax Act No. 14 of 2002 including the repeal of SVAT with effect from January 1, 2024.

Echoing concerns raised by exporters and businesses, the Ceylon Chamber of Commerce last week warned that the elimination of SVAT would immediately hit the exporters with cash flow issues, while disrupting cash flow in various downstream industries and suppliers, leading to a ripple effect of financial challenges.

The existing SVAT system was implemented in 2011 to address long-standing inefficiencies and delays in the VAT refund process managed by the Inland Revenue Department (IRD). Before SVAT, many exporters were cash-strapped due to delayed VAT refunds—some for up to five or six years.

The government acknowledged the concerns raised by exporters and other businesses on the removal of the SVAT system in particular in the absence of a strong alternative VAT repayment system.

“The representations made by the relevant parties point out that drastic issues may erupt in finance flow in relation to individuals especially the exporters who have been registered under the system at present if the simplified value–added tariff system is repealed without a strong Value – Added Tax repayment system,” the Department of Government Information said.

Against this backdrop, the Cabinet of Ministers this week decided to repeal the SVAT system in a phased manner until a strong VAT repayment system is established.

JAAF welcomes govt.’s decision

The Joint Apparel Association Forum (JAAF) yesterday welcomed the recent cabinet approval for the deferment of the Simplified Value-Added Tax (SVAT) scheme, set to take effect from April 1st, 2025.

In a statement to the media, JAAF said is particularly appreciative of the decision to ensure that a ‘strong tax repaying mechanism’ is in place before proceeding with the removal of SVAT. It stressed that the decision reflects the dedicated efforts of various stakeholders to protect the industry, for which JAAF is appreciative.

“This deferment comes at a critical time for apparel exporters who have been grappling with declining exports and therefore, risk of cash flow disruption if SVAT was removed without a viable refund system being in place,” said JAAF added. Exporters have pointed out that as an appropriate measure towards repealing the SVAT system, a step-by-step approach is required until a strong tax repaying mechanism is established.

“The deferment offers a lifeline to our sector, ensuring a smoother transition towards a revamped tax framework. We remain committed to working collaboratively with all stakeholders to ensure the industry’s continued growth and prosperity,” said JAAF.

By Nishel Fernando

40 train services to operate today despite strike

In light of the current train strike, the Railways Department has made an announcement regarding today's scheduled train services.